Mr Market is Not Always Right

Mr Market is Not Always Right

July 31, 2020

Have you ever heard the story of Mr. Market? If not, I think it is a great analogy to learn and understand, especially during these difficult times we find ourselves in.

Benjamin Graham, the legendary value investor and author of Warren Buffett’s favorite book “The Intelligent Investor”, wrote the allegory of Mr. Market to describe a phenomenon that happens to you every single day as an investor.

Graham asks you to imagine that you are one of the two owners of a business, along with a partner called Mr. Market. Your partner frequently offers to sell his share of the business or to buy your share with his estimate of the business's value going from very pessimistic to wildly optimistic in short periods of time. You are always free to decline the partner's offer, since he will soon come back with an entirely different offer the next day.

Mr. Market is often identified as:

- Is emotional, euphoric, moody

- Is often irrational

- Offers that transactions are strictly at your option

- Is there to serve you, not to guide you.

- Will offer you a chance to buy low, and sell high

- Is frequently efficient…but not always efficient.

This behavior of Mr. Market allows you, the investor, to wait until Mr. Market is in a 'pessimistic mood' and offers a low sale price before you buy more stock.

That’s because you have the option to buy at that low price knowing very well that Mr. Market is just in one of his moods. Therefore, patience is an important virtue when dealing with Mr. Market.

This story is simple, but it paints an important picture. When you buy stock in a public company, you are partnering up with Mr. Market.

Every day when that opening bell rings, and every second until the closing bell thereafter, he will quote you wildly fluctuating prices. Sometimes his prices may fluctuate so wildly and so violently that you may feel scared about the value of your business holdings.

Don’t let Mr. Market scare you. Understand his manic-depressive tendencies, and you will be better off for it.

One last thing to note as well is that it may be in your best interest to SELL one of your business holdings if Mr. Market becomes overly optimistic. This unfounded optimism on his part could be the opportunity you need to get out of a position you no longer want to be invested in at a very favorable price.

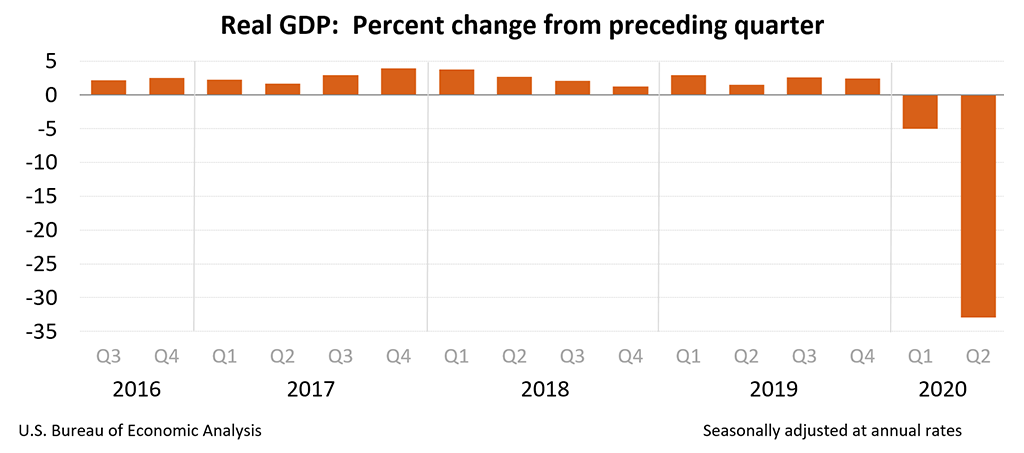

For example, compare the following two images. One shows the stock market’s performance over the past 4 years. The other shows the GDP (Gross Domestic Product) movements each quarter.

With a GDP Print of -30% from the previous quarter, it may be time to examine Mr. Market’s optimism and trim extraneous stock positions.

I am not saying to sell it all and hide under a rock. Continue making your retirement contributions, continue to maintain your emergency fund, and continue to manage your expenses so that you are saving a large portion of your income.

But remember, Mr. Market is not always right. And right now, I think he may be way off the mark.

Please stay safe and feel free to reach out to us if you have any investing and trading questions.

MDAS

If you thought this was helpful, terrible, or somewhere in the middle, please leave me feedback in the form of a Direct Message on instagram @MakeDollarsAndSense, or feel free to send me an e-mail/text to the information on my Home Page. I truly appreciate constructive criticism and opposing views, so bring em on!

P.S. New blog posts coming your way every Monday!

Previous Article: The Stocks That Are Going UP During the Coronavirus Crash

Next Article: The Importance of Diversification

My Favorites

Tags

Finance Money Saving Investing Debt Financial Freedom FIRE Financial Independence

Audible

I love books, so it is probably a natural progression that I have come to LOVE AUDIOBOOKS! Here is a link to a 30-day free trial to Audible, along with TWO free audiobooks of your choice. Don't like the service? No problem, they will let you cancel and you'll even get to keep the books you chose to try. Enjoy!